VAT Check

VAT CHECK

Automatic VAT validation in Salesforce

VAT identification number validation

VAT Check: Before doing business across borders in the EU, companies need to validate the VAT identification number – also called VAT number – of their business partners.

The VAT Check via JustOn Billing & Invoice Management gives our customers the security that an European VAT information exists.

This means our customers can ensure that their business partners are subject to value-added tax and can sell their goods or services VAT-free in B2B business. If companies do not chec k the VAT identification number and it is found that the customer’s information was incorrect, the companies will pay the VAT themselves.

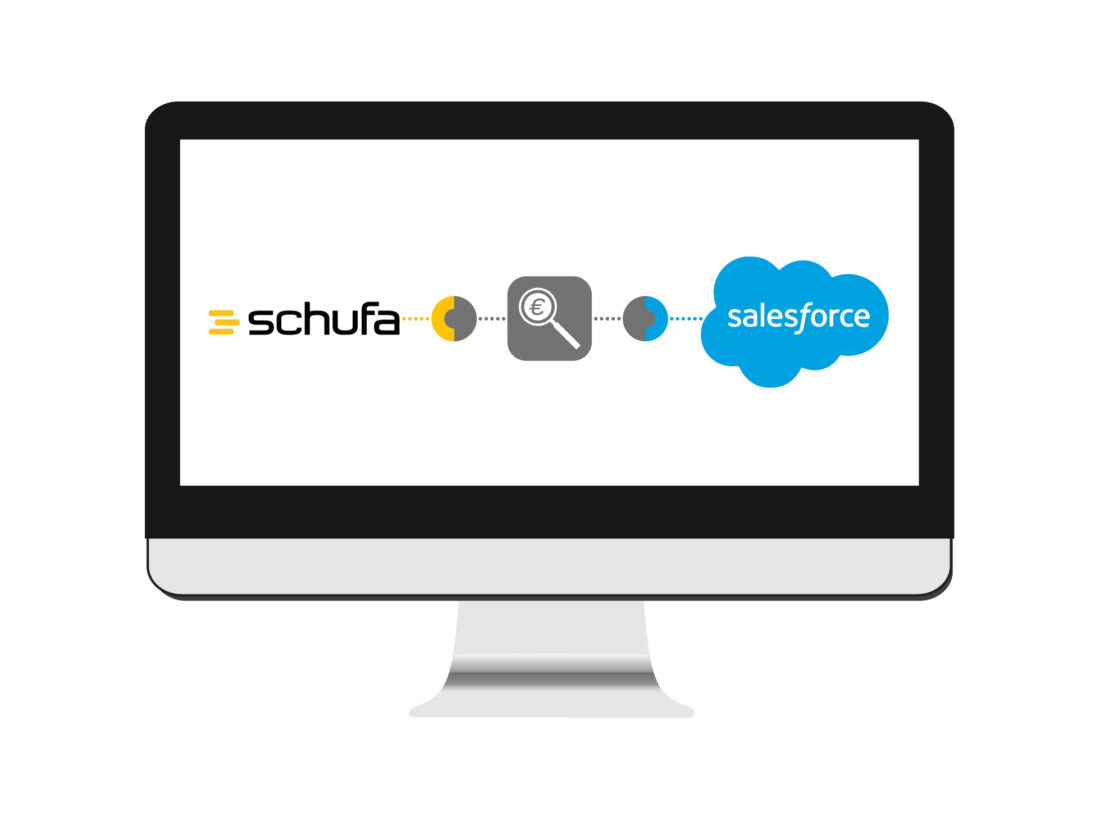

Direct connection to the VAT information exchange service

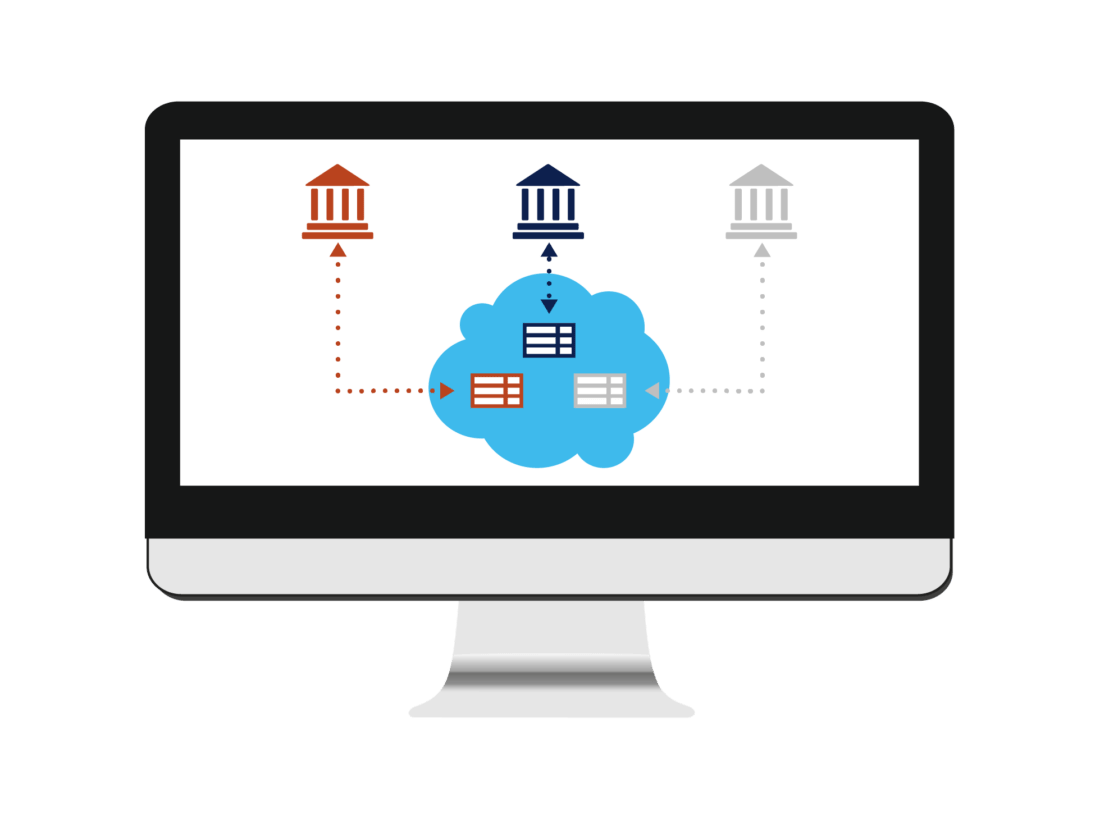

JustOn Billing & Invoice Management offers a direct integration with the European VAT Information Exchange System (VIES) for VAT validation.

This system searches VAT identification numbers in national VAT databases and tells whether EU VAT information exists.

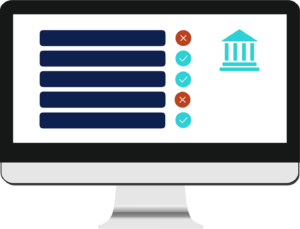

VAT information at a glance

Using the integration with VIES you can directly check if a company is registered for cross-border business within the EU. This validation is done by an automatic check of the VAT number of one or more accounts.

As a result, you will know if the VAT number is valid.

You will also receive:

- the name and address associated linked to the VAT number (if permitted by the relevant country)

- the timestamps of the last checks and

- any error messages.

Information of the invalidity of VAT numbers

If VIES indicates that a VAT number is invalid, this may be du to various reasons.

Either the VAT number does not exist in the databases that are accessed by VIES or the number is not activated for cross-border transactions within the countries of the European Union. It is also possible that the company is not yet registered with its VAT number, but the registration is already in progress.

Changes may not be reflected immediately in the national databases, which is why VIES may not always retrieve current information.