In

Continue Reading

Continue Reading

Accounts Receivable

Reliable payment and accounts receivables management

Automatic accounts receivable

JustOn solves your challenges in accounts receivable management.

The software controls the process from booking an invoice, to checking the incoming payment, managing credits, creating reminders, and to registering and booking the payment receipt.

Preconfigured revenue reports help you to find late payments and to remind outstanding amounts.

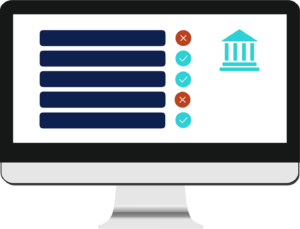

Balance overview

Balance overviews and revenue reports show all customer transactions at a glance, be it debits or credits. The 360-degree customer view facilitates your account management.

With JustOn you always have a clear view on your customer’s balance records:

- Invoices

- Credits

- Payment transactions

- Refunds

- Prepayments

- Dunning reminder fees

Fast and correct payment registration

JustOn registers incoming payments from external systems and assigns them to invoices.

Preconfigured interfaces to payment providers allow faster payments:

- Mollie

- Adyen

JustOn also supports payments, payment management and payment reconciliation by

- an EBICS compliant bank integration

- the automatic SEPA direct debit

Reliable dunning process

The software automatically generates and sends reminders for outstanding payments. This helps accelerating account settlement.

- The integrated dunning feature supports you in

- Tracking and

- Claiming outstanding payments

In the dunning proccess, you define how your customers have to settle due amounts:

- Dunning levels

- Payment due dates

- Dunning fees

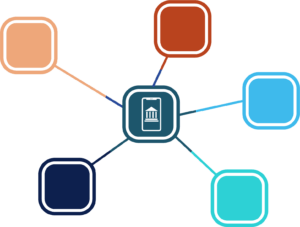

Data transfer in accounting systems

Use the JustOn integrations to external accounting systems like DATEV, SAP or Sage. This makes it perfectly easy to directly transfer invoices, payment data and relevant booking details to your tax consultants.

In this context, JustOn supports you by

- Generating booking details for invoices

- Exporting invoices to CSV files

- Generating account statements that summarize the transactions of a customer for a certain period

- Performing the initial account assignment

Direct data transfer to DATEV

The JustOn Connector for DATEV, made by JustOn and DATEV, provides for a secure and direct transfer of bookkeeping data from JustOn to DATEV Unternehmen online.

Use the JustOn Connector for DATEV to transfer all documents and relevant accounting data to the DATEV systems and thus to your tax consultancy.

Take a test drive or install our free 30 days trial: you get it on Salesforce marketplace AppExchange.

2. October 2023

In

Continue Reading

Continue Reading

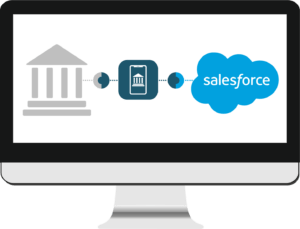

Banking in Salesforce

Banking in Salesforce

Automatic EBICS-compliant banking in Salesforce

Automatic Banking in Salesforce

JustOn Cash Management enables EBICS-compliant banking and thus automatic, secure data exchange between Salesforce CRM or Salesforce applications and banks.

In compliance with the European Electronic Banking Internet Communication Standard (EBICS), companies can use the app to manage incoming payments, trigger SEPA direct debits and reconcile transactions automatically.

Protection for sensitive financial data

The bank connection via the European communication standard EBICS guarantees the best possible protection for sensitive financial data and enables flexible communication with multiple banks (multibanking).

The EBICS-compliant bank integration receives payment information directly without third-party providers, imports it into Salesforce CRM and matches it to the corresponding outstanding receivable.

Overview of all banking data

Automatic banking via JustOn Cash Management offers one advantage above all.

All bank data, i.e. outgoing and incoming payments are mapped transparently, providing an overview of cash flow at all times.

Native Salesforce development

The bank integration, developed natively on Salesforce, integrates seamlessly with other JustOn products and all major ISV applications available on the Salesforce marketplace AppExchange – including Salesforce CPQ & Billing and Salesforce Order Management, as well as any custom object that maps a receivable.

Users work in the familiar Salesforce user interface with the security and effectiveness of the world’s best CRM platform.

2. October 2023

In

Continue Reading

Continue Reading

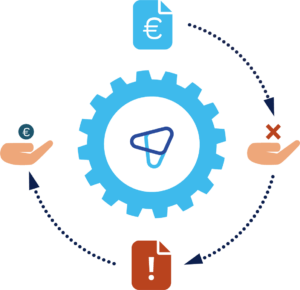

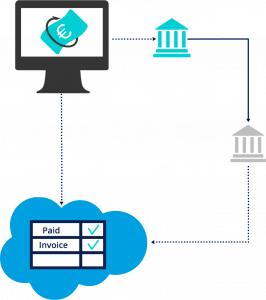

Automatic Payment Reconciliation

Automatic payment reconciliation

Matching of payments with invoices in Salesforce

Payment reconciliation via online banking

JustOn Cash Management connects your bank accounts via an EBICS-compliant integration with Salesforce and checks the incoming payments. It does not matter whether the payment was effected via a payment service provider, a SEPA direct debit or directly.

The system automatically matches incoming payments to your receivables stored in Salesforce. After successful matching, it completes the settlement, reconciling the receivables with the payments.

Direct connection to dunning processes

If payments have not been received, the system can n ow trigger the automatic dunning run to generate and send reminders and dunning letters.

Of course, you can use the automatic payment reconciliation and the following dunning process regardless of location and at any time, as they are 100% integrated into the Salesforce platform.

KPI at a glance

Automatic payment reconciliation is an important basis for successful liquidity management: It ensures that payments are received reliably and on time.

The extensive analysis functions of our software are helpful in this regard. Preconfigured or individual reports give you an overview of all transactions and your current cash flow. In addition, the analysis of the payment reconciliation helps you to make forecasts on customer churn.

Discover our products

Free web demo

We are happy to introduce JustOn products to you in a free web presentation.

Jetzt buchen

30 days trial

Test our software products for free and become convinced of its capabilitites.

Jetzt testen

2. October 2023

In

Continue Reading

Continue Reading

Analytics and Reports

Analytics and Reports

Data analytics for successful liquidity management

Key metrics at a glance

In addition to the automatic invoicing & payment management, JustOn offers a flexible analytics system.

Using preconfigured reports, which you can easily adjust to your needs, you always keep track of finances, customers and key performance indicators.

Data evaluation becomes the basis for creating value and new business models, thus becoming a genuine value itself.

Real-time revenue data

JustOn gives you real-time access to your revenue data. On this basis, you can develop new business models, improve the customer loyality and control your company purposefully using financial metrics.

The automated reporting system of JustOn shows for example insights into recurring revenue, one-time revenue and usage-based data.

The consistent use and analysis of data becomes an important driving force for your company’s growth.

Overview of revenues and KPI

Our data analytics and reports not only give you an overview of your revenues, but also of all relevant key performance indicators (KPI).

Automated reports and analyses also enable you to evaluate key performance indicators in a well-founded manner:

- Revenue

- Monthly recurring revenue (MRR)

- Customer lifetime value (CLV)

- Cashflow

- Customer churn rates

360-Degree Customer View

Analytics and reports are gaining ever more importance with respect to the customer and the customer churn. Transparent reports show the payment behaviour, which can be used to forecast future customer behavior, detect customer churn at an early stage and, at best, prevent it.

JustOn offers a reporting system, that combines different data:

- Customer and usage-based data

- Trouble ticket and order management data

- Invoicing and accounting data

Based on customized reports, you can create customer profiles that help you to improve the customer loyality.

Data analysis as key to success

The JustOn analytics system enables revenue forecasts, becoming the sound base for the future development of your business, your products and services.

The enhanced analytics and reporting capabilities, which include contract-based data, and the view on relevant key indicators allow you to generate, for example, real-time previews of expected revenue based on current contracts or subscriptions.

JustOn also considers the accrued liabilities. The accrual represents a particular challenge in revenue forecasting because sales are not always posted in the period in which they are settled (revenue recognition).

2. October 2023