In

Continue Reading

Continue Reading

Media & Publishing

Automatic invoicing solves the challenges of the media industry

Media in the digital transition

Digitization has dominated the business processes in the media and publishing industry for many years.

New business areas are emerging, the competition between traditional media companies and digital-only publishers is steadily increasing, and services are converging.

Media companies no longer just offer content and advertising space, but also their own technology solutions.

Automated billing for the competitive edge

Financial process automation software – such as that from JustOn – enables media providers to monetize all aspects of their business.

Ad management for the advertising industry and subscriptions for their readers and users can be billed equally in a unified system.

This begins with the mapping of the contract model, continues with automatic invoicing and dunning through to the reconciliation of incoming payments with outstanding invoices and the transfer of data to accounting systems.

Special challenges for Media & Publishing

Media and publishing companies face these challenges, among others, when billing & invoicing for their services:

- Automatic generation of a large number of outgoing invoices

- Sales, customer retention and customer management

- Segmentation into B2B and B2C customers

- Combining subscription business with other business areas

- Complexity of advertising orders

- Operating digital marketplaces

- Invoicing billions of clicks

JustOn offers solutions for media & publishing

So nutzen Medienunternehmen unsere Produkte

Sorry, no posts matched your criteria.

Weitere Success Stories

Get to know our products

20. November 2023

In

Continue Reading

Continue Reading

Professional Services

Professional Services

Automated financial processes for more focus on the core business

Digitization empowers knowledge-intensive business services (KIBS)

Professional services – as providers of knowledge-intensive and consulting services – are part of a growing industry.

Specific to this segment is the strong focus of its experts on their specialist tasks.

And this is where digitization can make the decisive difference.

Multiple areas of application

The industry is characterized by a particularly wide variety of application areas. These include, among others:

- Management consulting

- Human resources consulting

- Engineering offices

- Law firms

- Financial Auditors

- Advertising and marketing agencies

- Software solution providers

Challenges for professional service provider

Particularly in professional services, it is essential to keep the high administrative workload to a minimum.

This is the only way the experts can focus on their core competencies: knowledge and consulting.

To get there, providers need digitized and thus automated processes for managing customers, projects, billing, invoicing and accounting.

JustOn offers solutions for professional services

So nutzen Professional-Service-Anbieter unsere Produkte

Sorry, no posts matched your criteria.

Weitere Success Stories

Get to know our products

20. November 2023

In

Continue Reading

Continue Reading

Property Technologies

Property Technologies

Automated financials as base for stable business success

Technologization of the real estate sector

In the real estate industry – real estate services – areas of work are becoming increasingly digitalized.

The use of new technologies (property technologies) is automating traditional areas of the industry or offering the opportunity to offer new products and services.

The digital transformation is seen as a guarantee for the future of traditional real estate services, as the automation of key processes minimizes administrative costs and the core business can be expanded and optimized with the resources gained.

Property Technologies

Property technologies – or PropTechs for short – have become the digital future of the real estate industry. They bring innovative products and services to the market.

Using the latest information and communication technologies, they optimize traditional areas of the real estate industry or develop innovative business models in new areas.

Office & Facility Management

Office and facility management is a specialized market within the area of property technologies, which has developed into a strong, independent industry over the past decades.

The industry’s portfolio now includes not only facility maintenance, property cleaning and asset management, but also a wide range of other services around buildings, homes and offices. They include, for example, security services, coffee deliveries or indoor plant rentals.

Managing intelligent facility technologies will soon become a key area of this industry.

Areas of application

- Real estate brokerage and marketing

- Financing and investments

- Property management, cleaning and administration

- Supply of office materials

- Offering innovative building technologies

- Developing construction projects

- Smart building and smart home

- Mobility in the real estate industry

Automated billing & invoicing

PropTechs must reduce administrative costs as much as possible in order to fully exploit the opportunities offered by these core areas.

The way to success is to automate time-consuming processes such as invoicing, dunning and accounting.

The direct integration of data collection systems with highly specialized billing solutions is particularly recommended in the area of intelligent building technologies.

Challenges for PropTechs

Property technology providers face the following specific challenges when automating their financial processes:

- Automatic generation of a large number of outgoing invoices

- Monetizing complex and individual pricing models based on subscriptions, one-time payments, commissions and discounts

- Tax-compliant invoicing worldwide

- Recording, processing and billing consumption data

- Transparency in billing – informative billing

- Flexibility in pricing

JustOn offers solutions for PropTechs

So nutzen Anbieter von PropTechs unsere Produkte

Sorry, no posts matched your criteria.

Weitere Success Stories

Get to know our products

20. November 2023

In

Continue Reading

Continue Reading

Software as a Service

Software as a Service

Automated financial processes for more growth

Business model of the future

Software as a Service (SaaS) is a growing industry and one of the major business sectors of the future.

SaaS, as an area of cloud computing, is a distribution model through which you offer software as a service.

To a large extent, the success of this business model depends on the level of administrative effort and therefore on the ability to automate it.

Automated billing & invoicing

For SaaS, the automation of billing processes, invoice mangement and accounts receivable management is particularly suitable.

This way, SaaS providers can save significant amounts of time and money and then profitably use these resources to expand their services.

Special challenges for SaaS

Software as a Service providers face these challenges, among others, in billing for their services:

- Automatic generation of a large number of outgoing invoices

- Mapping complex business models and flexibility in customization

- Billing recurring licenses, one-time products and services as well as consumption-based data

- Support for multiple payment methods

- Tax-compliant invoicing worldwide

JustOn offers functions for SaaS

So nutzen Anbieter von SaaS unsere Produkte

Sorry, no posts matched your criteria.

Weitere Success Stories

Get to know our products

24. October 2023

In

Continue Reading

Continue Reading

Payment via Payment Provider

Payment via Payment Provider

Integrated payment service provider for direct online payments

Advantages of payment providers

A payment service provider (PSP) – also known as a payment gateway – is a service provider that offers companies the technical integration of various payment types.

PSPs automate online payments and are therefore an important basis for online sales. They make it easier for companies to sell products and services, as they offer their customers multiple payment methods via a single contractual partner – including common payment methods such as purchase on account, SEPA direct debit, payment with credit and debit cards such as Visa or MasterCard, or online payment systems like PayPal.

Using a payment service provider saves time and money and offers both companies and their customers security.

Mollie und Adyen

JustOn therefore offers companies integrations to popular and secure payment service providers:

- Mollie

- Adyen

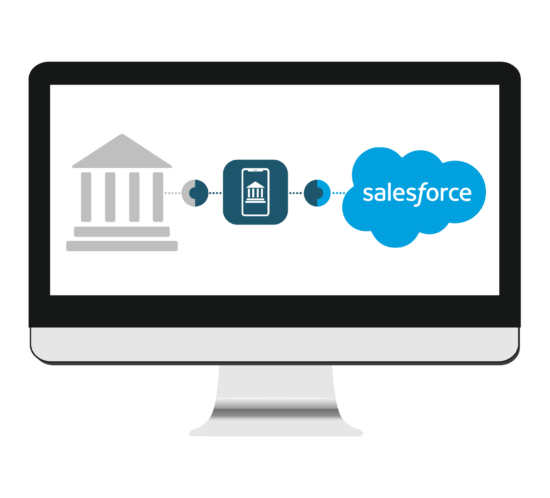

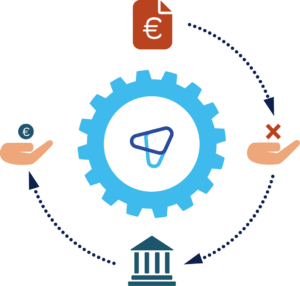

Our product JustOn Cash Management integrates these payment service providers into your Salesforce org in order to exchange payment data via. This enables your customers of pay for purchases of products or services using a payment page.

Find out more about the technical details and requirements in our technical documentation.

4. October 2023

In

Continue Reading

Continue Reading

Payment via SEPA direct debit

Payment via SEPA direct debit

SEPA direct debit for recurring payments

Recurring payment via SEPA direct debit

To effectively process recurring payments, it makes sense for companies and customers to settle the payment via SEPA direct debit.

A SEPA direct debit mandate allows the payee to debit the amount as agreed in the contract from the payer’s account by direct debit. At the same time, the payer’s bank is authorized to pay the amount.

Import and verification of SEPA mandates

JustOn supports the fast and easy import of your customers’ SEPA mandates.

Our software validates the format and structure of the IBAN and BIC and saves the mandate as well as the bank details in the customer’s account. This information is linked to the receivables. If payments are due, they can now be collected conveniently by direct debit.

If the customer already has a SEPA mandate, this is also visible with all the information in the customer’s account.

4. October 2023

In

Continue Reading

Continue Reading

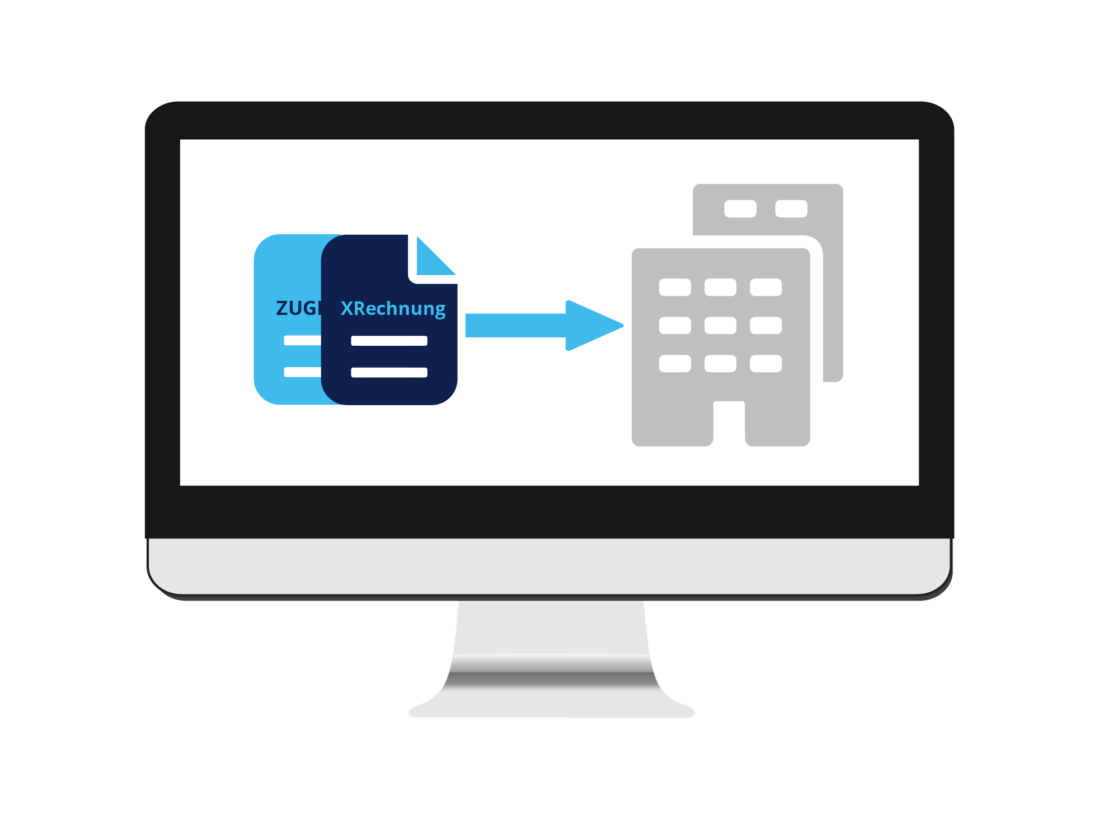

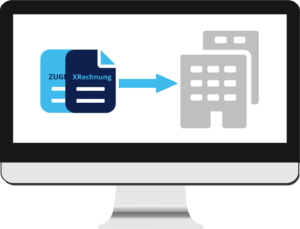

XRechnung and ZUGFeRD

XRechnung and ZUGFeRD

E-invoicing standards for Germany and Europe

Legally compliant e-invoicing standards

Since November 2020, the e-invoice regulation has been in force, which defines the standards for electronic invoicing for public sector contracts in Germany and Europe. The invoice formats XRechnung and ZUGFeRD have been defined as compliant with the law.

JustOn Billing & Invoice Management ensures that companies in Germany and Europe can create their invoices according to these invoicing standards and send them to public contract partners.

XRechnung and ZUGFeRD

XRechnung is the first e-standard to be established. It is based on an XML data model and developed especially for the exchange of electronic invoices with public clients. The standard is designed to standardized invoice formats and to improve security.

The ZUGFeRD invoice profile complies with the XRechnung e-invoice standard and can therefore also be used for invoicing public sector customers.

More efficiency through electronic invoice exchange

Especially companies that process many public contracts will benefit from this service, which guarantees legal compliance, seamless processing and immediate payments.

Electronic invoice exchange between companies and public-sector clients is made much more efficient in this way.

4. October 2023

In

Continue Reading

Continue Reading

Recurring Payments

Recurring payments

Payments for Subscriptions

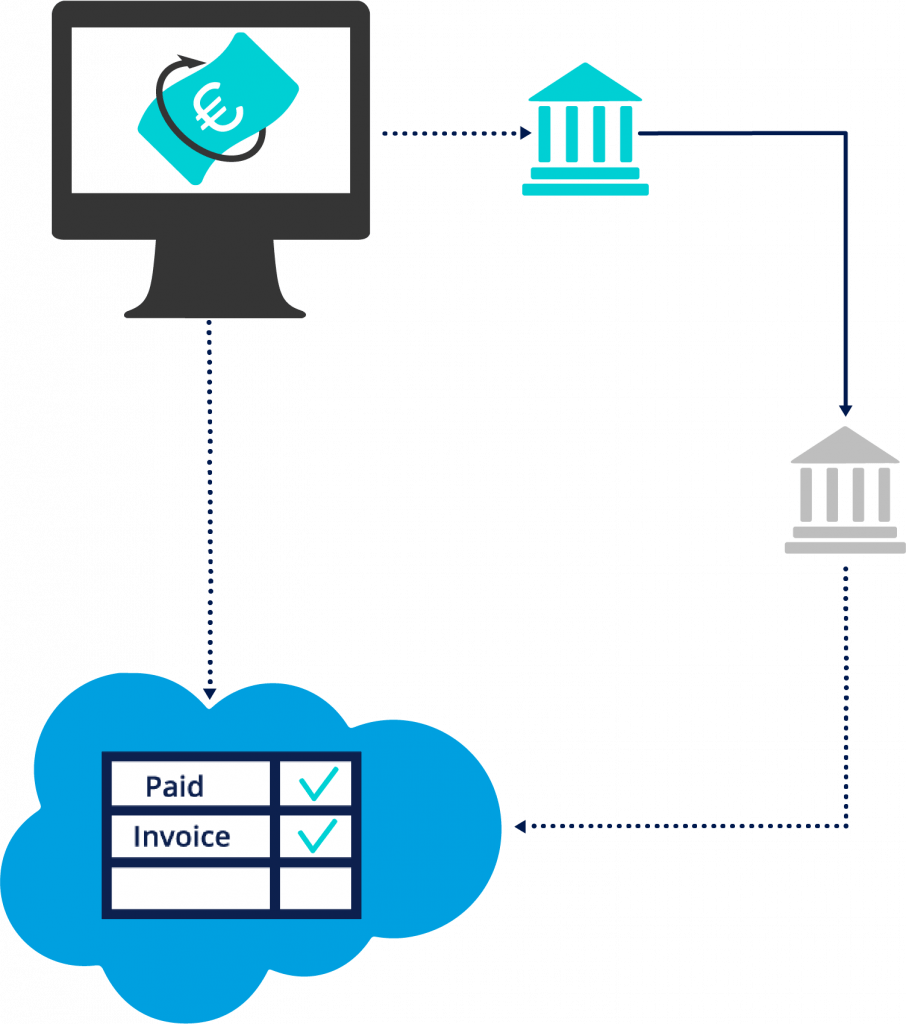

Recurring payments ensure regular incoming payment

Recurring payments are the payments that are due when subscriptions are billed. They are to be repeated on a regular basis or at specified times within certain periods.

Common practices include, for example, monthly, quarterly, semi-annual or annual payments, which are booked at the same intervals. This results – for example – in monthly recurring revenue (MRR), which is an important key performance indicator in the subscription business. Recurring payments offer the same benefits to companies and their customers as recurring billing.

Wide variety of payment options

JustOn offers users automatic SEPA direct debit and integrations with well-known payment providers such as Adyen and Mollie. Recurring payments are automatically debited.

The payment providers Adyen and Mollie provide numerous payment methods (Apple Pay, PayPal, Visa, etc.) that you can make available to your customers.

Less administrative effort and more certainty in liquidity planning

Companies benefit from recurring payments made by their customers for several reasons.

On the one hand, payments are received on time, eliminating the need for reminders or dunning letters. The receipt of recurring payments is easier to verify and the payment reconciliation can be automated. The company saves on administrative effort and has more time available for core tasks.

On the other hand, revenues can be reliably planned. Recurring payments based on subscriptions make up a solid foundation for successful liquidity management. It is easy to estimate revenues precisely (e.g., via MRR reports), the cash flow is steady, and even customer churn is easier to take into account in financial planning.

Better customer relations

Of course, there are benefits for customers as well.

After a one-time entry of invoice data, the data is periodically transferred and the amounts are debited on the fixed billing dates via the selected payment method. This saves customers time-consuming manual transfers.

Customers can be sure that their money is transferred directly from the bank or via payment service providers and that their sensitive financial data is stored securely.

In this way, recurring payment processes improve the relationship between companies and customers.

4. October 2023

In

Continue Reading

Continue Reading

Recurring Billing

Recurring Billing

Recurring billing of subscriptions in Salesforce

Recurring billing – a model for success

Subscription billing – the recurring billing based on subscriptions and periodic contracts – is a particular strength of our software. Creating recurring invoices is based on an automated process that enables companies to generate and send invoices to their customers at regular intervals.

Recurring billing is an important part of the subscription management, the most successful business model of our time. This model owes its success to several key advantages it offers companies and customers compared to one-time sales.

Benefits of Subscription Billing

A subscription model allows companies to combine details like products, prices and terms in one contract, the billing of which can be easily automated. Using subscriptions, end customers are given the flexibility to buy products and services precisely according to their own needs.

These contracts, which are typical for subscription management, offer further benefits for companies and their customers: Through regularly receiving payments, companies can better assess their liquidity, prospectively plan their finances, and build long-term customer relationships. Customers, on the other hand, benefit from predictable, regular and constant expenses and their planning over a long term.

Subscriptions as basis for recurring billing

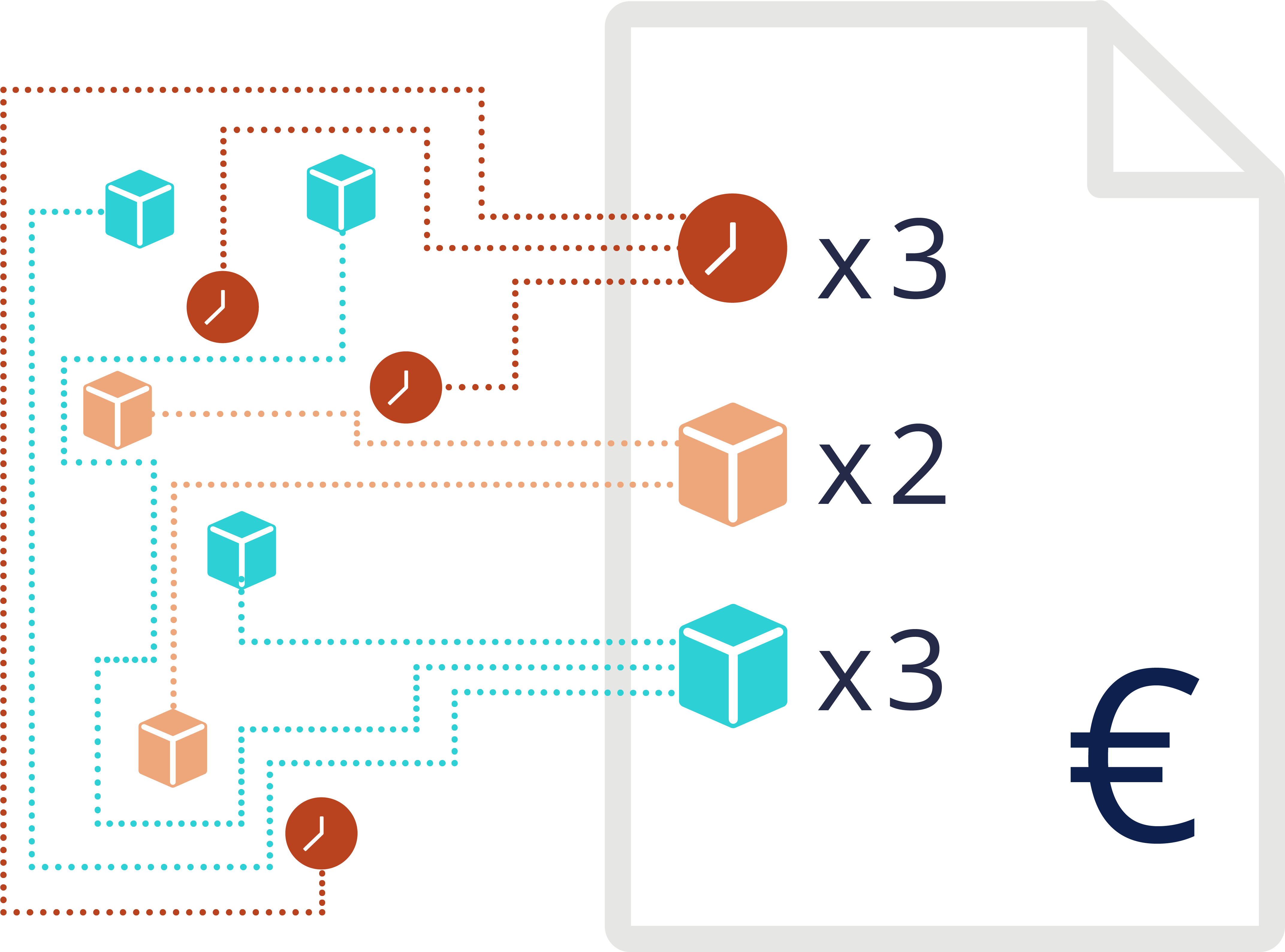

Subscription contracts record and manage all data relevant to billing:

- Items in the form of products or services

- Pricing model including price tiers, discounts and automatic price increases

- Options for installments

- Start and end dates of the contract

- Due dates

The subscription becomes the billing plan for both parties. From the subscription, JustOn Billing & Invoice Management collects all the invoicing-relevant data and creates your invoices via an automatic invoice run.

To this end, it combines account information such as name and address with the products booked in the subscription contract, the pricing model and the due dates.

From invoice to payment

The regular generation of recurring invoices is seamlessly followed by the distribution to customers, SEPA direct debit collection, automatic verification of incoming payments, receivables management via an automated dunning run, and payment reconciliation.

Customers can pay their invoices directly via the payment page of JustOn Cash Management or, in prospectively issue a SEPA mandate for direct debit collection.

4. October 2023