XRechnung and ZUGFeRD

XRechnung and ZUGFeRD

E-invoicing standards for Germany and Europe

Legally compliant e-invoicing standards

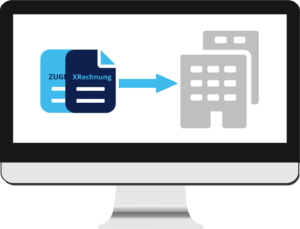

Since November 2020, the e-invoice regulation has been in force, which defines the standards for electronic invoicing for public sector contracts in Germany and Europe. The invoice formats XRechnung and ZUGFeRD have been defined as compliant with the law.

JustOn Billing & Invoice Management ensures that companies in Germany and Europe can create their invoices according to these invoicing standards and send them to public contract partners.

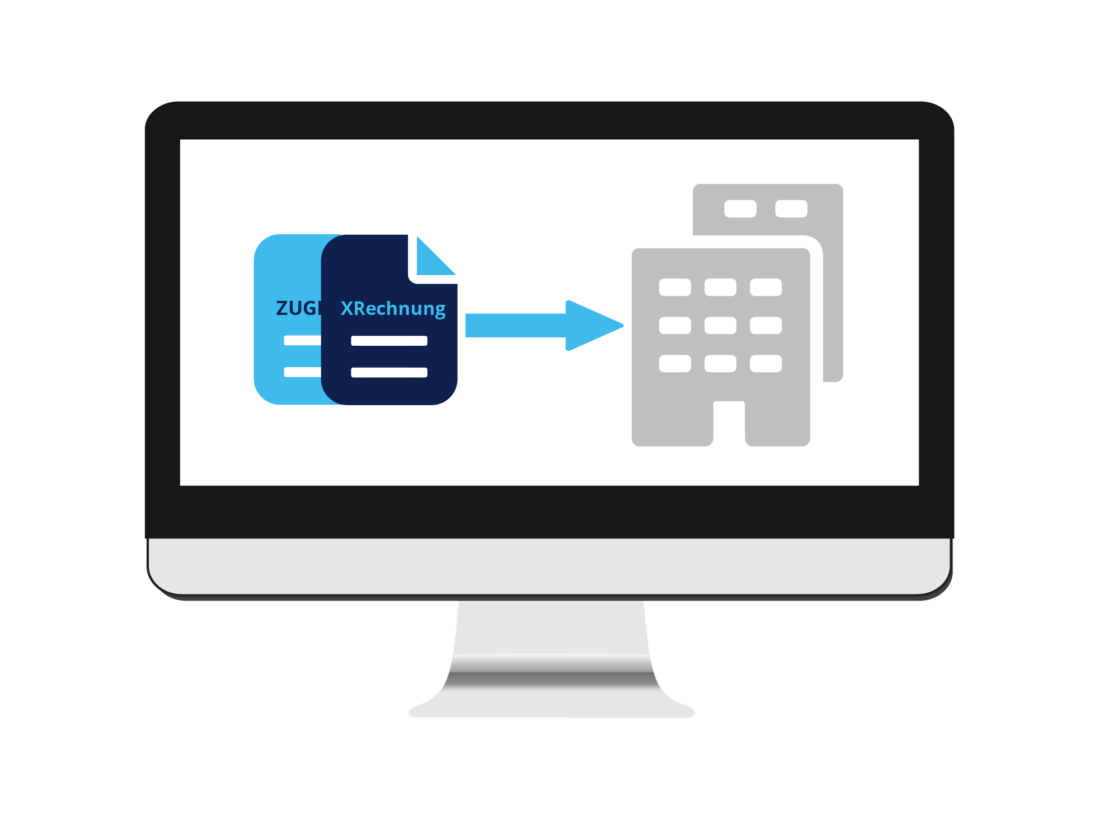

XRechnung and ZUGFeRD

XRechnung is the first e-standard to be established. It is based on an XML data model and developed especially for the exchange of electronic invoices with public clients. The standard is designed to standardized invoice formats and to improve security.

The ZUGFeRD invoice profile complies with the XRechnung e-invoice standard and can therefore also be used for invoicing public sector customers.

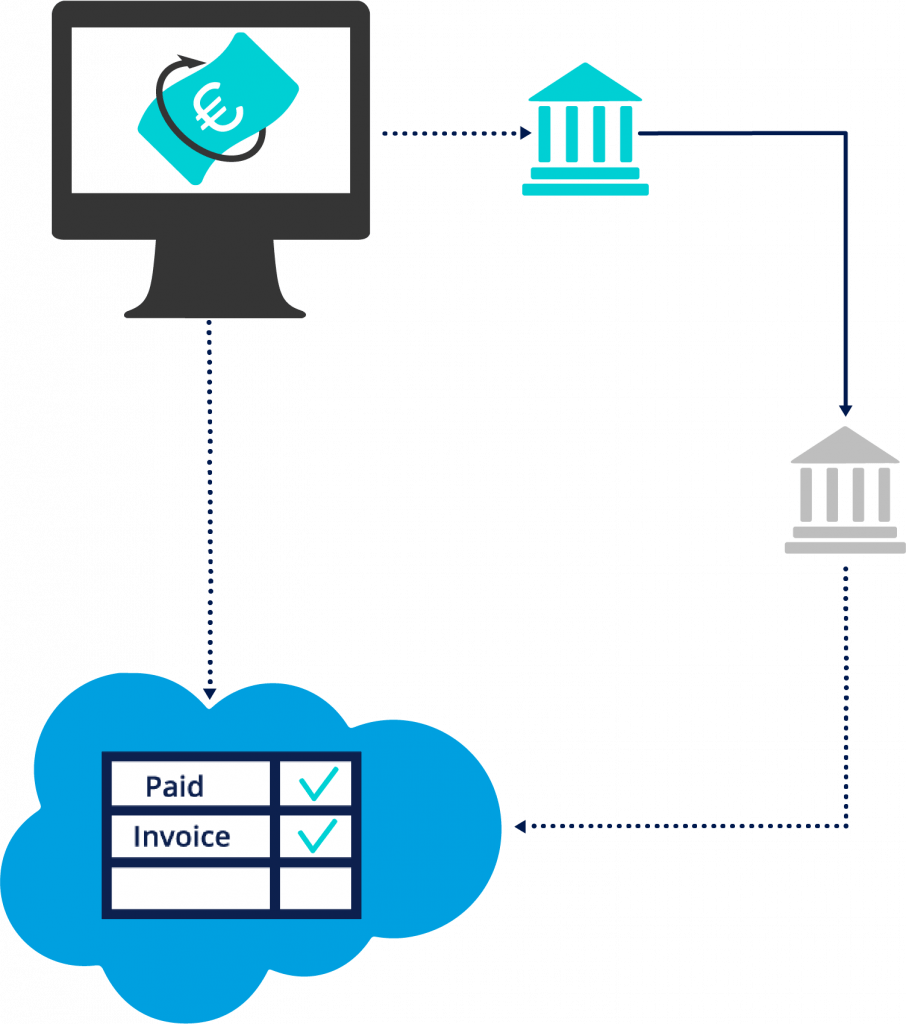

More efficiency through electronic invoice exchange

Especially companies that process many public contracts will benefit from this service, which guarantees legal compliance, seamless processing and immediate payments.

Electronic invoice exchange between companies and public-sector clients is made much more efficient in this way.