GoB and GoBD Compliance

GoB and GOBD compliance

GoB and GoBD compliance as a tax law basis

GoB and GoBD: The principles of proper accounting

Since 2015, the Principles of Proper Accounting (GoB) and the Principles for the Proper Keeping and Storage of Books, Records and Documents in Electronic Form and for Data Access (GoBD) have applied throughout Germany as the tax law basis. They set out the rules for creating, changing, arranging and archiving invoice documents.

Since 2017, non-compliance with these principles can result in fines.

In order to act safely here, it is recommended that companies automate their billing & invoicing processes using software that already complies with the principles. Our products are certified and offer this security to customers.

Automatic financial processes as solution

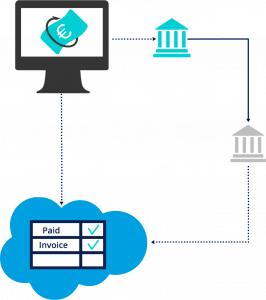

Automated, digital financial processes make it much easier to comply with the principles – which are complicated at first glance – and offer far-reaching advantages over manual invoice generation in other programs.

Software products from JustOn guarantee tax-compliant invoice creation, seamless, secure and timely archiving of data and receipts, and document storage.

In addition, the verifiability of all bookings is improved.

Companies benefit from time savings both during the fiscal year and when preparing the annual accounts, for which the software already provides the complete information.

Certification according to IDW PS 880

JustOn Billing & Invoice Management is certified according to IDW PS 880 standard for information security applicable in Germany. This certificate gives users the assurance that the principles for creating, editing and archiving invoice documents in the billing process are being followed.

The IDW PS 880 standard confirms that automatic billing & invoicing using software from JustOn complies with the GoB and the GoBD.

Even if these principles change, our customers are on the safe side because our software is regularly adapted to the new regulations.